Bitcoin is a digital currency, that is native to the internet. It was the first successful attempt to produce a currency independent of any central authority like a bank or Government. Trustless & transferable electronically from person to person instantly without the need to trust a middle man. It is a way to transmit value over a similar network that the makes internet work.

People liken it to digital cash because only the holder has the ability to spend it. Like cash. And likewise only the holder has the ability to destroy it.

The cash like comparison enables a defensive use case for Bitcoin. Thinking about Bitcoin as an insurance policy against an incessant “print your way out of trouble” policy of Quantitive Easing. This policy continues today under the guise of Covid-19.

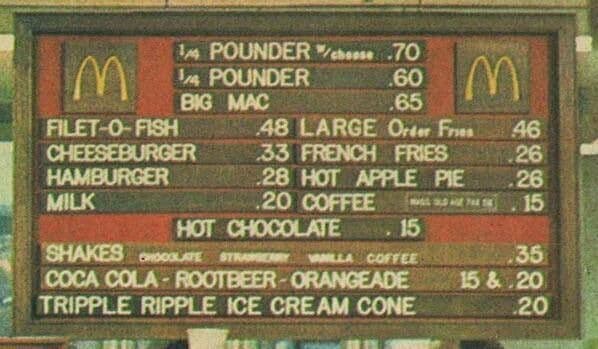

Inflation means the purchase power of the money you earned yesterday has diminished today. Illustrated below.

There will ever only be 21,000,000 bitcoins.

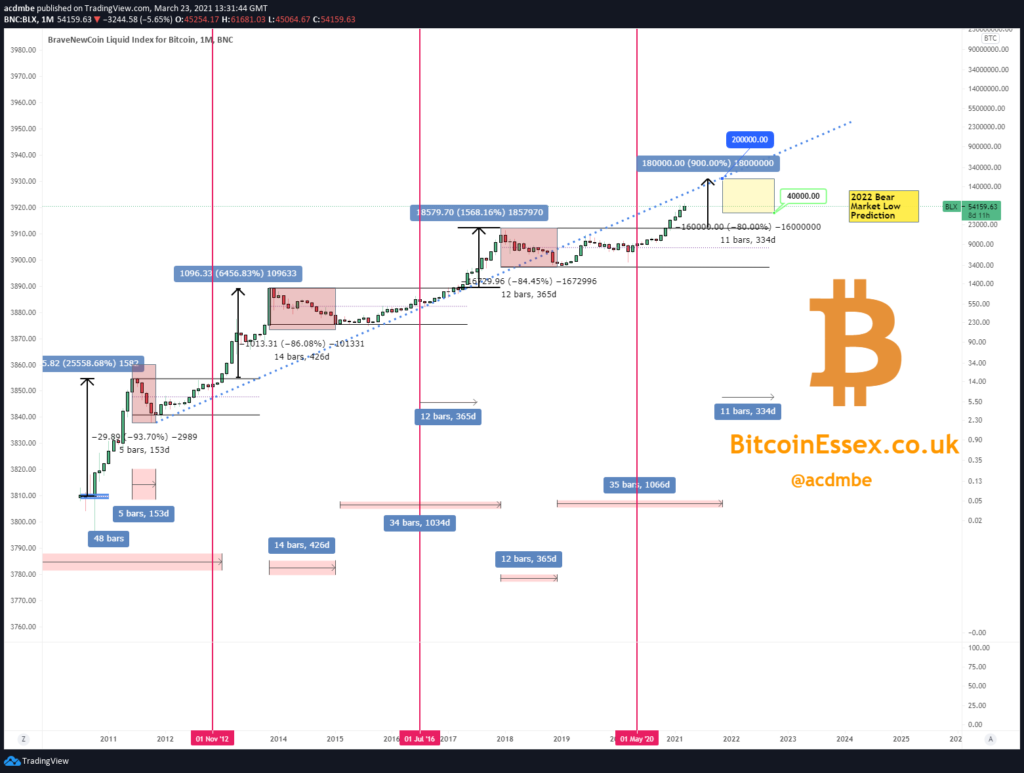

On January 2017 1 Bitcoin was worth $1000. By December 2017 1 Bitcoin was worth $20,000 by March 2021 1 Bitcoin was worth $61000

A Bitcoin is divisible into a hundred millionth of a bitcoin.

a satoshi is the smallest amount within bitcoin representing 0.00000001 bitcoin, one hundred millionth of a bitcoin.[4] A millibitcoin equals to 0.001 bitcoin, one thousandth of a bitcoin or 100,000 satoshis.

Bitcoin is a store of value. Its a better store of value than the US Dollar for example.

Let’s measure the inflation of McDonalds, I like to measure this with brands like McDonalds as they are a prime indicator on efficiency in the workplace. Their entire business model thrives on low margins and high volume. Once upon a time not long ago the price of a big mac was

Protect yourself, Protect your family, Protect your wealth.